尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Global banks and asset managers have extended a total of $119bn of financing to 20 major agribusinesses linked to deforestation in the five years since the Paris agreement was brought into force, according to an investigation by the Global Witness campaign group.

全球见证组织(Global Witness)的一项调查显示,在《巴黎协定》生效后的5年里,全球银行和资产管理公司向20家与森林砍伐有关的大型农业企业提供了总计1190亿美元的融资。

Leading global lenders JPMorgan, HSBC and Bank of America were among the biggest funders of the companies, which included Brazilian meat producer JBS, each striking dozens of funding deals between 2016 and 2020, the research found.

研究发现,全球领先的银行摩根大通(JPMorgan)、汇丰(HSBC)和美国银行(Bank of America)都是这些公司的最大资助者,其中包括巴西肉类生产商JBS,每家银行都在2016年至2020年期间各达成了数十笔融资交易。

Deals included almost $730m-worth of financing for Olam International, one of the world’s largest food ingredient suppliers, and its subsidiaries from JPMorgan via revolving credit facilities, the data showed. Olam International is under investigation by the Forest Stewardship Council for allegedly destroying rainforest in Gabon.

数据显示,这些交易包括通过循环信贷安排,为全球最大食品配料供应商之一Olam International及其子公司从摩根大通获得价值近7.3亿美元的融资。因涉嫌破坏加蓬的雨林,Olam International正在接受Forest Stewardship Council的调查。

Deforestation is a major source of carbon emissions, and tackling the issue is expected to be among the topics under discussion by global negotiators at the upcoming COP26 UN climate summit in the UK.

森林砍伐是碳排放的主要来源,解决这一问题预计将是即将在英国举行的COP26联合国气候峰会上全球谈判代表讨论的议题之一。

Despite the growing interest among companies in planting carbon-absorbing trees, tackling deforestation in supply chains remains a less of a mainstream issue for many investors than other environmental concerns such as measuring direct corporate emissions.

尽管企业对种植可吸收碳的树木的兴趣日益浓厚,但对许多投资者来说,解决供应链中的森林砍伐问题仍然不如衡量企业直接排放等其他环境问题那样成为一个主流问题。

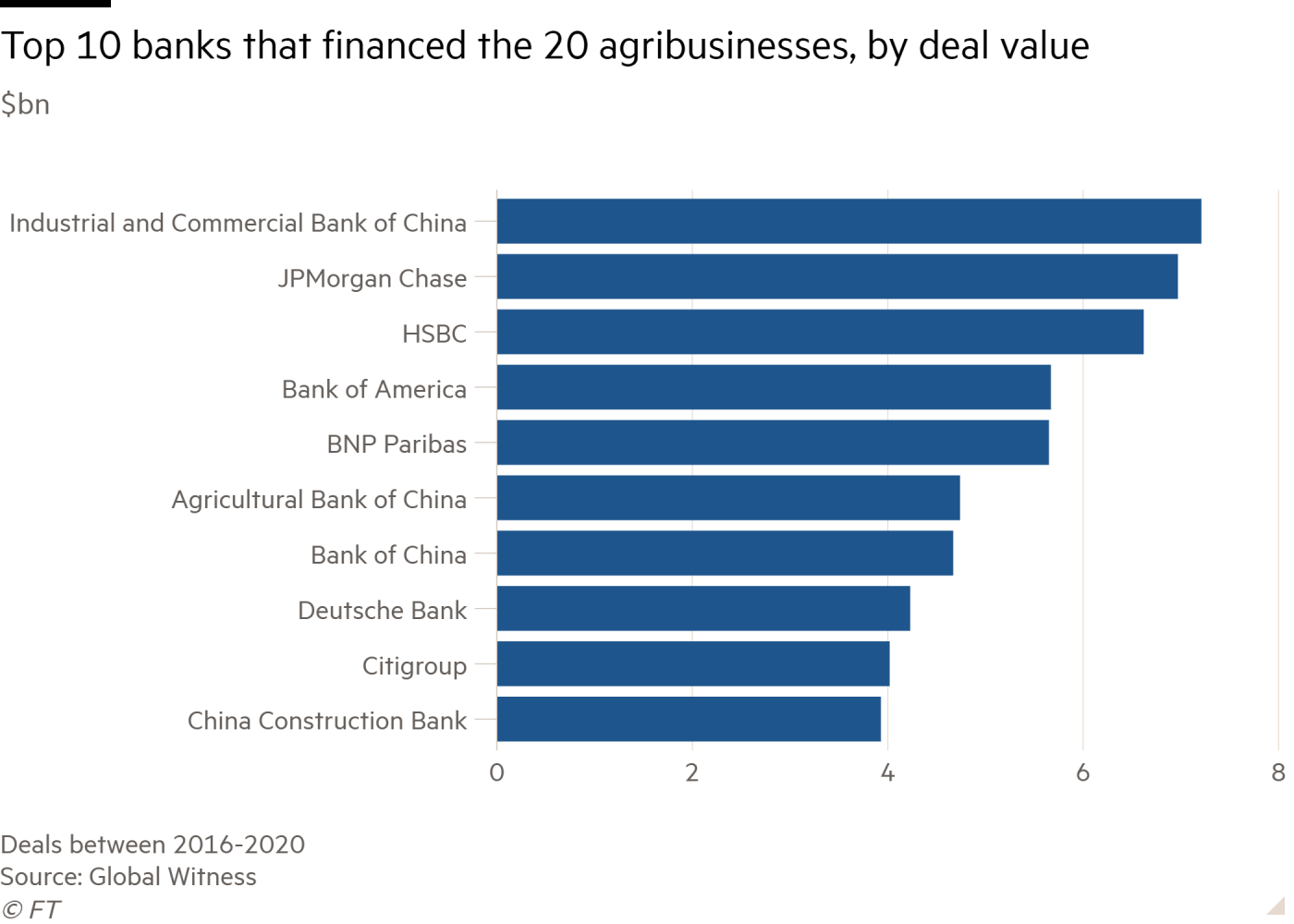

Data on more than 5,000 deals, shared with the FT, indicate that the top five banks by total deal value — which included BNP Paribas and the Industrial and Commercial Bank of China (ICBC) — struck almost 570 bond, credit, and underwriting deals with 20 agribusinesses over the period, worth a combined $32bn.

与英国《金融时报》分享的5000多笔交易的数据显示,按交易总额计算的前五大银行——包括法国巴黎银行(BNP Paribas)和中国工商银行(ICBC)——在这一时期与20家农业企业达成了近570笔债券、信贷和承销交易,总价值达320亿美元。

All five institutions except the ICBC have “no-deforestation” policies. All 20 agribusinesses have been publicly linked to deforestation, and were listed in a database of companies active in forest-risk sectors, such as soy palm and beef, assembled by the global coalition of campaign and research organisations under the Forests & Finance umbrella group.

除中国工商银行外,所有五个机构都有“不砍伐森林”政策。所有20家农业综合企业都与毁林有公开联系,并被列入一个在森林风险行业(如大豆、棕榈和牛肉)活跃公司数据库。由全球多家从事研究和倡导的组织发起的联盟“森林与金融”(Forests & Finance)创建了这一数据库。

“Despite the fact that many of these banks have voluntary commitments on deforestation and on climate change, they’re continuing to have relationships with companies that are linked to deforestation,” said Colin Robertson, senior forests investigator at Global Witness.

全球见证组织的高级森林调查员科林·罗伯逊说:“尽管许多银行在森林砍伐和气候变化方面都有自愿承诺,但它们仍在继续与那些与森林砍伐有关的公司保持关系。”

“The overarching problem is there is a lack of [legal] obligation on banks” to change practices, he added.

他补充称:“最主要的问题是,银行缺乏(法律)义务”来改变做法。

As the largest, China’s ICBC arranged financing for eight of the 20 companies, the data show. That included providing about $1.1bn worth of loans and revolving credit facilities to commodities trader Cofco International, which has been at the centre of allegations by advocacy group Mighty Earth that suppliers linked to Cofco had cleared more than 20,000 hectares of forest in Brazil between 2019 and 2021.

数据显示,作为最大银行的中国工商银行为20家公司中的8家安排了融资。其中包括向大宗商品交易商中粮国际(Cofco International)提供价值约11亿美元的贷款和循环信贷安排。倡导组织Mighty Earth指控与中粮有关联的供应商在2019年至2021年期间砍伐了巴西逾2万公顷森林,中粮国际一直处于这些指控的中心。

Cofco said that no illegal deforestation occurred on farms it sourced from during that time.

中粮表示,在此期间,其采购产品的农场没有发生非法砍伐森林的情况。

JPMorgan, the second-largest financier, underwrote three bonds between 2018 and 2019 for commodities trader Cargill, which has been accused of sourcing soy grown in deforested areas.

第二大金融机构摩根大通在2018年至2019年期间为大宗商品交易商嘉吉(Cargill)承销了三笔债券。嘉吉一直被指采购毁林地区种植的大豆。

Last year, the salmon producer Grieg Seafood identified Cargill over its “soy-related deforestation risk in Brazil”. JPMorgan declined to comment.

去年,三文鱼生产商Grieg Seafood就嘉吉“在巴西与大豆相关的毁林风险”对其施压。摩根大通拒绝置评。

Cargill said it did not supply soy from farmers who cleared land illegally or in protected areas, and suspended suppliers that were found to be deforesting protected areas.

嘉吉公司表示,它不向非法开垦土地或在保护区内的农民供应大豆,并暂停了被发现在保护区内砍伐森林的供应商的资格。

Barclays and Santander, meanwhile, each underwrote three bonds between 2018 and 2019 for JBS, the meat producer that has faced scrutiny from activists and investors for links to destruction in the Amazon rainforest.

与此同时,巴克莱银行(Barclays)和桑坦德银行(Santander)在2018年至2019年期间分别为JBS承销了3只债券。这家肉类生产商因与亚马逊雨林的破坏有关联而面临活动人士和投资者的审查。

JBS said the company had a “zero-tolerance” policy for deforestation, and had stopped working with suppliers that breached it.

JBS表示,该公司对毁林采取“零容忍”政策,并已停止与违反这一政策的供应商合作。

Santander said the bank was “committed to protecting the Amazon” and expected its beef processing clients in the region to have a “fully traceable supply chain that is deforestation-free” by 2025.

桑坦德银行表示,该行“致力于保护亚马逊地区”,并预计到2025年,其在该地区的牛肉加工客户将拥有一个“完全可追溯的、不砍伐森林的供应链”。

Although many banks and investment groups have “no-deforestation” policies, they can be limited in their scope. For example, they may define deforestation as the destruction of certain tropical or rare forests, rather than of any woodland. The ban may also not extend to legal deforestation.

尽管许多银行和投资集团都有“不砍伐森林”的政策,但这些政策的范围可能是有限的。例如,它们可能将毁林定义为对某些热带或稀有森林的破坏,而不是对任何林地的破坏。禁令可能也不会延伸到合法的森林砍伐。

Policies can also be difficult to enforce and monitor. Banks may ask clients to ensure their suppliers are not involved in the destruction of forests, but many large food companies say they cannot account for the behaviour of every supplier.

这些也很难执行和监督。银行可能会要求客户确保他们的供应商没有参与毁林,但许多大型食品公司表示,他们无法对每一家供应商的行为负责。

Global Witness said the 20 agribusiness’s “problematic track records should have raised major red flags for bank compliance teams”.

全球见证组织表示,这20家农业企业的“有问题的记录本应该引起银行合规团队的高度警惕”。

Although lawmakers in the EU, UK and US have proposed regulations designed to eliminate deforestation from businesses’ supply chains, none would extend the additional due diligence requirements to financial institutions.

尽管欧盟、英国和美国的立法者已经提议制定旨在消除企业供应链中毁林行为的发挥,但他们都没将额外的尽职调查要求扩展至覆盖金融机构。

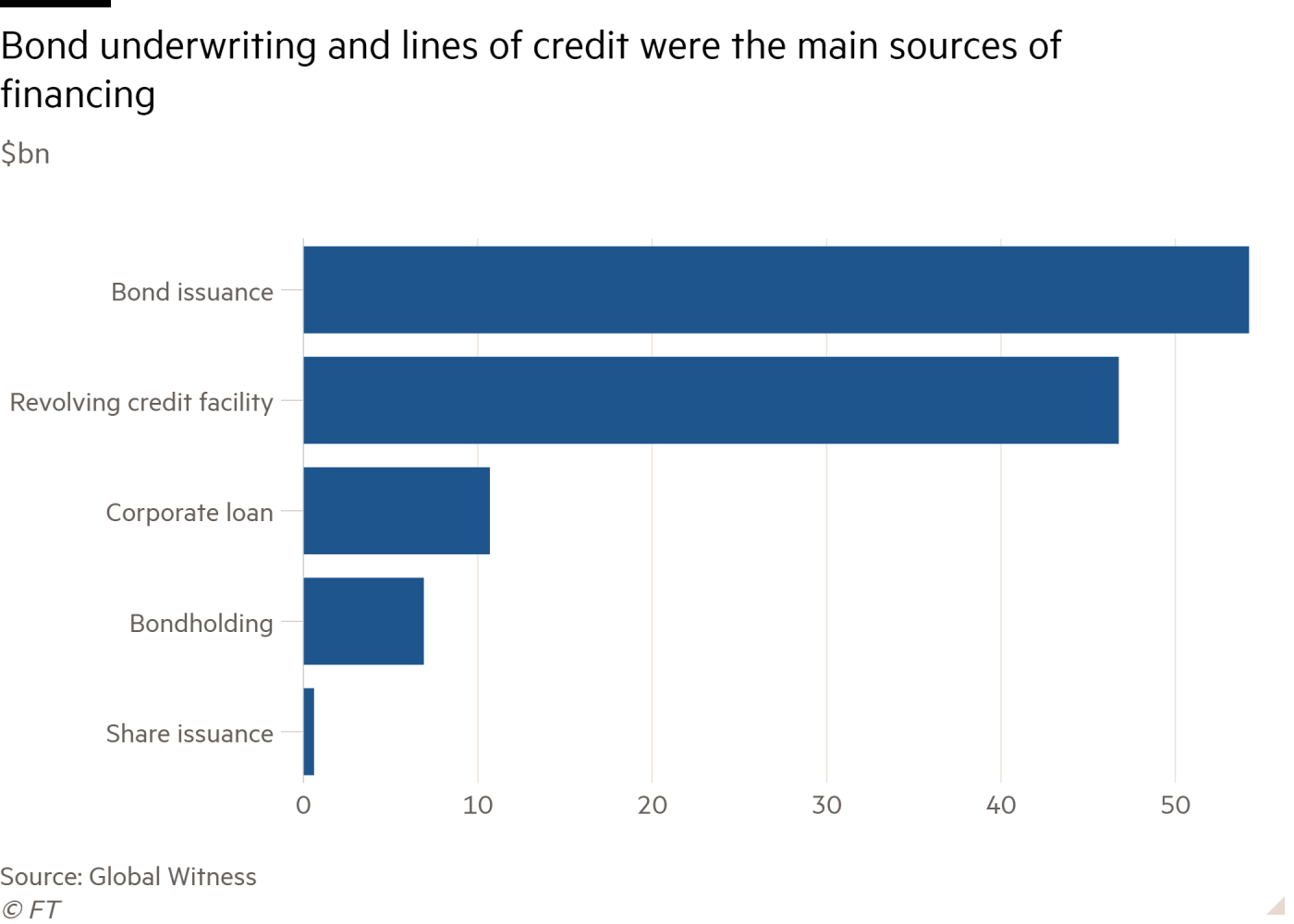

The Global Witness research involved analysis of bond and share issue underwriting agreements, as well as bond holdings and lines of credit from lenders headquartered in the UK, EU, US, and China. Bond issuances were the biggest source of funds, followed by revolving credit facilities and corporate loans. The year that Paris accord on global warming came into force, 2016, was the busiest dealmaking year by value, followed by 2019.

全球见证的研究包括分析债券和股票发行承销协议,以及总部位于英国、欧盟、美国和中国的银行的债券持有量和信贷额度。债券发行是最大的资金来源,其次是循环信贷安排和企业贷款。按价值计算,应对全球变暖的巴黎协定生效的2016年是最繁忙的交易年,其次是2019年。

In addition to direct financing, the 1,500 banks and asset managers tracked in the database held about $37.5bn worth of shares in the 20 agribusinesses, as of the fourth quarter of 2020, the data showed.

数据显示,除直接融资外,截至2020年第四季度,数据库中追踪的1500家银行和资产管理公司持有20家农业企业价值约375亿美元的股份。

HSBC said the bank “has exited, is in the process of exiting or has no banking relationship related to forestry, palm oil or cattle with the majority of entities named in the report”.

汇丰银行表示,该银行“已经退出、正在退出或与报告中提到的大多数实体没有与林业、棕榈油或畜牧业有关的银行业务关系”。

BNP said the list collated by Forests & Finance “does not identify actual deforestation practices but rather ranks all companies whose activities may be considered ‘at risk’ for forests”. Ceasing to fund companies in risky sectors “would have no positive impact on their practices, as they would continue to be able to rely on a number of other lenders”, it added.

法国巴黎银行表示,森林与金融公司整理的这份名单“并没有确定实际的森林砍伐行为,而是对所有活动可能被认为对森林‘有风险’的公司进行了排名”。该机构补充称,停止为高风险行业的公司提供资金“不会对它们的做法产生积极影响,因为它们将继续能够依赖其他一些银行”。

Barclays, Bank of America and Olam declined to comment. ICBC did not respond to a request for comment.

巴克莱、美国银行和Olam均拒绝置评。工行没有回应记者的置评请求。

Follow @ftclimate on Instagram

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here