Bee venom, sheep grease, snail slime — the list of extraordinary ingredients used by the $450bn-a-year beauty world is as endless as the ways in which its elixirs are marketed. Premiumisation has long been one route to profits, with ever more expensive brands hitting the shelves.

The next move in this space may well be provided by technology. At-home devices using LED lights, lasers and electromagnetic pulses, long-espoused by dermatologists to reduce wrinkles, tone or solve specific problems, are seeking space on investors’ shelves alongside a London IPO of The Beauty Tech Group.

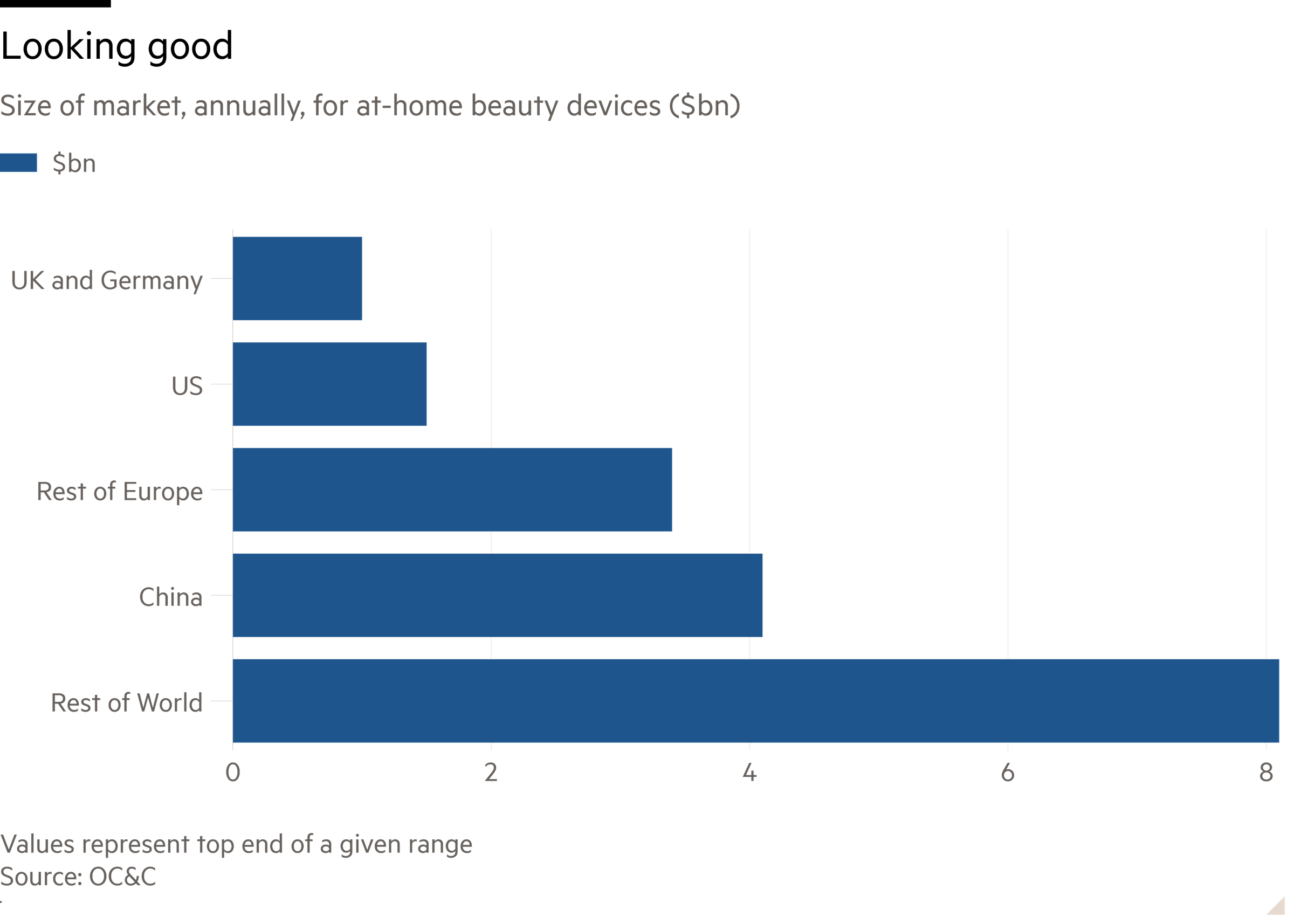

This is potentially an attractive pocket of the market. The beauty tech sector, according to a report for The Beauty Tech Group by consultancy OC&C, is worth up to $18bn globally. Sales have been growing at least 13 per cent a year in the US, UK and Germany since 2019. That’s more than three times the growth in the wider beauty industry, as estimated by McKinsey.

The beauty tech IPO hopeful produces devices under the CurrentBody, ZIIP and Tria Laser brands and sells direct to consumers or via retailers. It increased revenue by more than a fifth in the first half of this year while operating profit more than doubled.

The idea of a quiet few minutes under a mask or helmet — for hair regrowth — has obvious appeal at home over the hassle of keeping appointments. And while many will balk at masks costing somewhere between £300-£800, there are precedents for wellness tech gadgets doing well.

An armchair athlete with, say, tight calves who bought a percussive massage gun from, say, Therabody — a snip at £399 for the prime model — may be more open to its LED TheraFace mask at £579.

It is also worth remembering that it is nine years since Dyson first made inroads into the seemingly mature hairdryer market with high-priced high-quality products. Its rival Shark is meanwhile testing the beauty tech waters with its CryoGlow mask for £300.

The downside, of course, is that for every tech or wellness trend that flies off the shelves, there are others whose initial glow doesn’t last.

Investors casting an appraising eye over The Beauty Tech Group will probably demand a discount compared to the average 15 times ebitda commanded by established but slower growing companies such as Estée Lauder, Shiseido, Amorepacific and L’Oréal.

Masks are culturally odd: think films such as V is for Vendetta, Scream or Phantom of the Opera. Still, the beauty industry’s size and success is proof that customers can be convinced to use almost anything if they’re promised youth and better looks. In the meantime, pass the snail mucin, please.