US companies have been piling into the market for convertible bonds as they search for ways to keep their interest costs down, in a rare flurry of activity in otherwise subdued corporate fundraising markets.

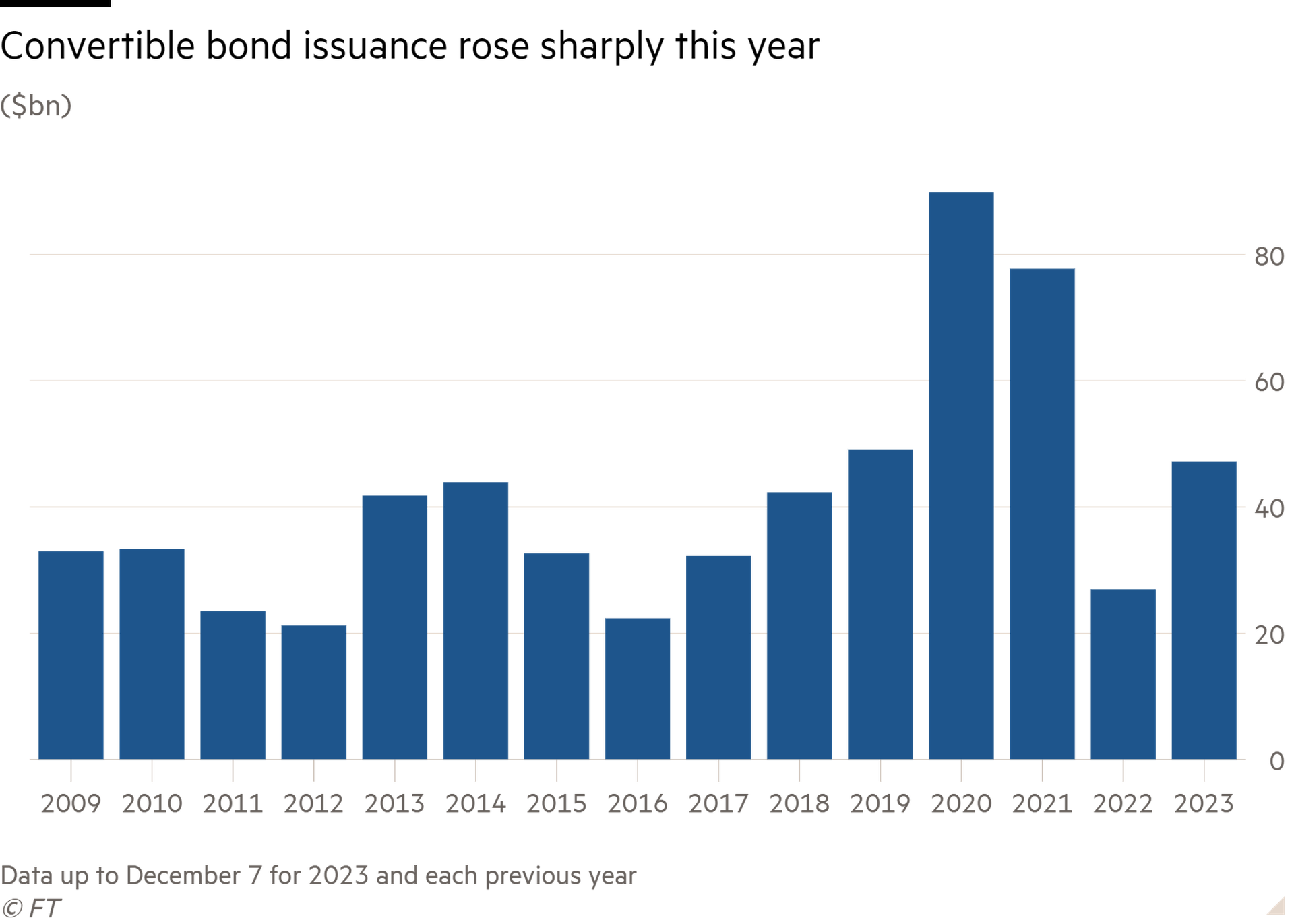

Issuance of convertible debt climbed by 77 per cent last year to $48bn, according to data from LSEG, making it one of the only areas of capital markets to return to pre-pandemic averages after 2022’s market downturn.

Experts say the boom in convertibles, a type of bond that can be swapped for shares if a company’s stock price hits a pre-agreed level, is likely to continue this year as companies refinance a wave of maturing debt.

The debt has traditionally been popular with younger technology and biotech groups that struggle to access mainstream bond markets. But more established companies have also dived in as the Federal Reserve’s interest rate hikes have driven up borrowing costs even for investment-grade companies.

“Historically converts had sometimes been seen as one of those spivvier products that investment-grade names stayed away from,” said Bryan Goldstein, who advises companies on convertible deals at Matthews South. “Now some big name issuers have come to the market, that narrative has shifted — it is seen as an attractive product on its own merits.”

Convertibles offer borrowers lower interest rates than traditional bonds without the immediate dilution for shareholders that would come through selling new stock. While 2023’s total issuance was lower than the record levels hit in 2020 and 2021, when companies took advantage of net-zero interest rates to shore up their balance sheets, it was well above the average of $34bn for the decade to 2019.

That is a stark contrast to the markets for initial public offerings, follow-on share sales, high-yield debt and leveraged loans, where volumes are still languishing well below pre-pandemic levels.

For borrowers, the savings can be substantial. The average yield on conventional investment-grade bonds has risen from 2.5 per cent at the start of 2022 to 5.2 per cent today, according to Ice BofA data. Average junk bond yields have risen from 4.9 per cent to about 7.8 per cent in that period.

By contrast, car-sharing group Uber issued a $1.5bn convertible in November at an interest rate of less than 1 per cent.

Michael Youngworth, convertible bond strategist at Bank of America, said convertibles typically cut between 2.5 and 3 percentage points from the debt’s interest rate — translating into tens of millions of dollars in annual savings for a deal like Uber’s.

Other companies to have tapped the convertible bond market in recent weeks include utility giant PG&E — whose credit rating puts it at the higher end of the “junk” category — and fellow energy group Evergy, an investment-grade borrower.

For both utilities, part of the rationale for issuing convertibles — worth $1.9bn and $1.2bn respectively — was to pay down existing non-convertible term loans.

US investment-grade companies have a record $1.26tn of debt to refinance over the next five years, according to an October report from rating agency Moody’s, up 12 per cent from the previous half-decade period. Junk-rated companies have $1.87tn across both bonds and loans.

“Converts are going to stay popular because we have a massive maturity wall that’s about to hit,” said Ken Wallach, co-head of global capital markets at law firm Simpson Thacher. “In 2020 and 2021, companies issued all this five-year paper in a much lower rate environment during the height of the pandemic.”